2nd mortgages. In case your initial mortgage doesn’t cover plenty of in the upfront money wanted, you may get a second mortgage. Fannie Mae sponsors a program termed Group Seconds® that helps you to get further funding to include your down payment and shutting fees from the municipality, non-earnings, employer, or An additional economical housing program.

These two loan varieties offer identical pros. Both have very low down payment specifications, generating them an incredible selection for customers without lots of money to put down. Loans are even obtainable with no down payment, if the customer qualifies.

And, there are actually nationwide programs far too. You simply must dig up what’s offered in your town. In many instances, you can acquire support for your down payment and all closing expenses involved with a loan.

This essential stage can save you sizeable effort and time by narrowing down what homes you may be able to obtain. During this move, your lender will explore exactly how much you'll be able to pay for and provide you with a warning to any pink flags that will hold you back from qualifying for any USDA loan.

Soon after an introductory period, your regular monthly payments may perhaps go up or down, as the rate is modified based on the cost to borrow on the market.

Potential buyers can qualify for USDA loans with a credit score score as little as 580. Acquiring a quote by New American Funding is simple both through phone or throughout the company’s streamlined on the internet portal.

The truth is the fact that soaring housing fees and stagnant wages make housing unattainable without affordable solutions. buff.ly/3jU9QBJ pic.twitter.com/yss5rBZDI9

You gained’t have the ability to tap into equity within an emergency. During a downturn, the lack of equity can likely bring about you owing much more around the house than it truly is value, which makes it tough to sell your home and transfer if that results in being vital.

Click below to apply for usda home loans ohio

Curiosity premiums could be higher: In some instances, You may have to pay an increased mortgage level due to the fact a lender could possibly see you as a better danger. The higher the curiosity price, the upper the cost of the loan.

This services could incorporate translations powered by Google. Google disclaims all warranties associated with the translations, express or implied, which includes any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a selected goal and noninfringement.

Questions and answers ought to be home or area relevant. One of the most handy contributions are in-depth and support others make superior choices.

Click the link to validate your zero-down mortgage eligibility. Does USDA allow gifts to aid with closing charges?

Don’t drive yourself insane Open up houses: What’s their purpose during the home-buying process? How to obtain a brief sale home Comprehensive guidebook to creating a house 9 Different types of Homes

Now we have created a list of national, state, and local programs offering mortgage aid and other sorts of housing assist in the usa to People with disabilities. Also, There are a variety of companies outlined that can offer advice and knowledge with reference to buying a primary home. First home proprietors guideline to mortgages. The Good Housing Act

As a result of pandemic, many households have made a decision to move away from congested city areas and into suburban parts. In many cases the reduce provide coupled with enhanced desire has resulted in the two better price ranges and rigid Levels of competition for many Attributes.

Very first-Time Homebuyers: The borrower and all other Grown ups who plan to live in the home within 12 months from closing needs to be initially-time homebuyers (haven't experienced an ownership curiosity inside their principal home during the preceding three many years).

Down payment support programs can also be a valuable way for purchasers to remain competitive—significantly in nowadays’s quick-going, small-inventory market.

Just recall, if you need to do receive a mortgage, create a plan for a way you are going to pay All those payments and track your prepare employing a Instrument like ReadyForZero.

Buyers with a incapacity or a disabled household member, who're eligible for just about any of these home loan programs, might also be qualified to obtain funds to create accessibility modifications for the home they get and may also be eligible for as much as $15,000 in the no fascination downpayment and closing Price support loan from the Entry Downpayment and shutting Cost Help Program.

This loan may be best for your needs in case you’re Completely ready for a way to transfer toward your goal of owning a home without putting other regions of your daily life on hold in an effort to help you save for a considerable down payment.

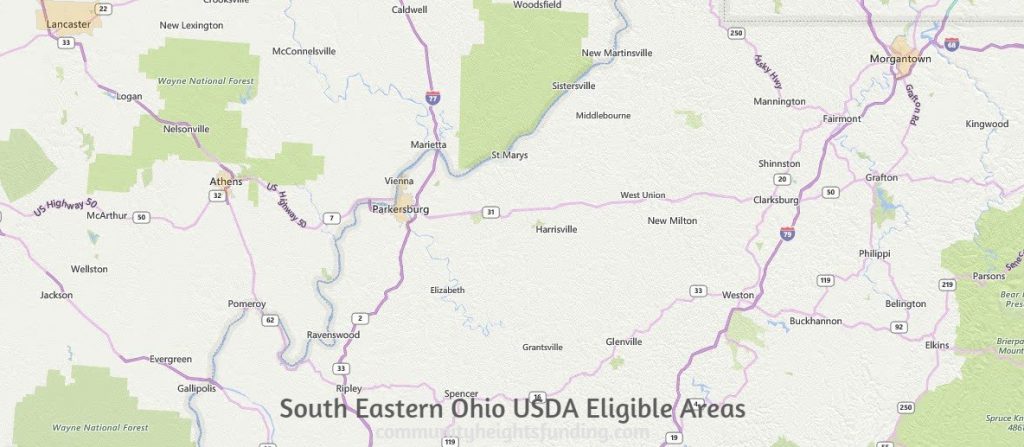

USDA Eligibility In Ohio

Navigating the economic facet of buying a home can really feel too much to handle. U.S. Lender is here to assist you make an knowledgeable selection when evaluating the different home mortgage loan options.

Therefore You'll have to apply with a USDA home loan-approved lender rather then Call the USDA. Here's an extensive list of approved lenders in Every single condition.

There are also government programs that will let you buy a home with no down payment When you are willing to acquire in qualified rural regions, or in qualified significant-crime areas.

The primary-time customer necessity isn't going to apply In case the borrower can be a veteran or is getting in the focused county or spot. Goal counties are indicated by a "T" within the listing of Buy Cost and Income limits (Appendix A). Be sure to Observe that some non-focus on counties have qualified neighborhoods within them as detailed in the appendix.

USDA loan qualifications tend to be more comfortable than Several other mortgage programs like typical loans. The defining attributes are that there is no down payment and the assets needs to be within an approved “rural†spot, which includes 97% of land in America.

Validate that the house is situated within an suitable region. The loans are only readily available for homes in rural spots. Seek advice from the USDA Web site to look at program availability throughout California.

These MPR’s largely address essential issues that would influence the safety, sanitation and structural integrity of your home, together with its worth.

Make use of your VA loan gain all over again in the event you promote or refinance a home you acquire check here with a VA-backed home loan